Funded Trading Accounts: What You Need to Know Before Applying 💼🚀

Are you ready to take your trading to the next level? Funded trading accounts offer an exciting opportunity to trade with significant capital without risking your own money. But before you dive in, there's crucial information you need to know. Let's unpack everything you should consider before applying for a funded account. 🧐

Key Takeaways:

Understand what funded trading accounts are and how they work

Learn the pros and cons of funded trading

Discover key factors to consider before applying

Find out how to prepare for the application process

Learn about different types of funding programs

What Are Funded Trading Accounts? 🤔

Funded trading accounts are provided by proprietary trading firms (prop firms) that give skilled traders access to substantial capital. Here's the basic concept:

You prove your trading skills through a challenge or evaluation

If successful, the firm provides you with trading capital

You trade with their money and share the profits

You must adhere to specific rules and risk management guidelines

Learn more about how funded accounts work

Pros and Cons of Funded Trading Accounts

Before applying, it's crucial to understand the advantages and potential drawbacks of funded trading.

Pros ✅

Trade with significant capital without personal financial risk

Potential for higher profits due to larger position sizes

Opportunity to start a professional trading career

Access to professional tools and sometimes mentorship

Develop disciplined trading habits

Cons ❌

Strict rules and limitations on trading style

Pressure to perform within specific parameters

Profit split means you don't keep all your earnings

Risk of losing the funded account if rules are broken

Potential for increased stress due to performance metrics

5 Key Factors to Consider Before Applying 🧐

Trading Experience: Most prop firms require a certain level of trading proficiency. Assess your skills honestly and choose a program that matches your experience level.

Capital Requirements: Understand all costs involved. Some programs require an initial fee or deposit.

Trading Style Compatibility: Ensure the firm's rules align with your preferred trading style (day trading, swing trading, etc.).

Profit Targets and Drawdown Limits: Familiarize yourself with the performance metrics you need to meet to maintain your account.

Platform and Instrument Availability: Verify that the firm offers the trading platforms and financial instruments you're comfortable with.

Use our prop firm comparison tool to find your best match

Types of Funded Trading Programs 📊

Not all funded accounts are created equal. Here are some common types:

One-Step Evaluation: Pass a single trading challenge to get funded.

Two-Step Evaluation: Complete two phases of trading challenges before funding.

Ongoing Evaluation: Start with a small account and scale up based on performance.

Instant Funding: Get funded immediately, often with more stringent profit-sharing terms.

Understanding these differences is crucial in choosing the right program for your needs and skills.

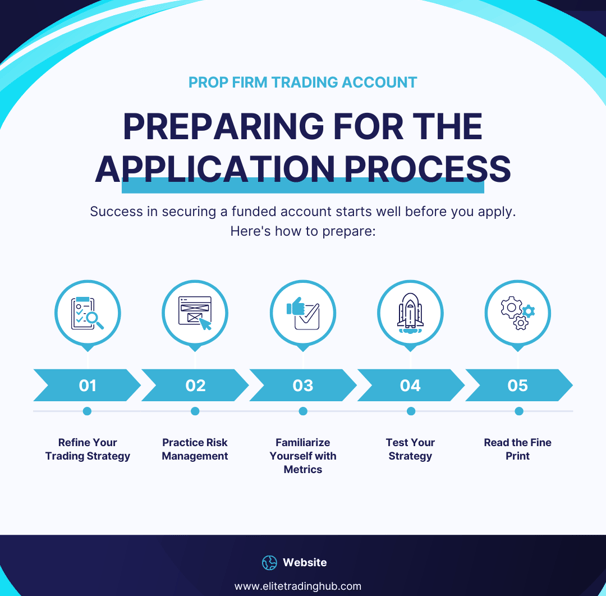

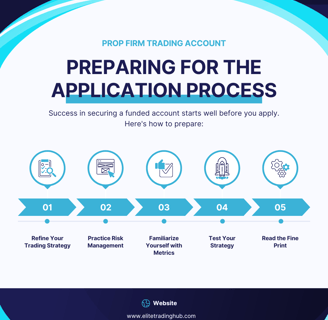

Preparing for the Application Process 📝

Success in securing a funded account starts well before you apply. Here's how to prepare:

Refine Your Trading Strategy: Ensure your strategy is consistent and aligns with the firm's rules.

Practice Risk Management: Many traders fail due to poor risk management. Master this skill before applying.

Familiarize Yourself with Metrics: Understand key performance indicators like win rate, profit factor, and maximum drawdown.

Test Your Strategy: Use a demo account to prove your strategy's effectiveness under the firm's conditions.

Read the Fine Print: Thoroughly understand the terms and conditions of the funding program.

Get our free funded account preparation checklist

Common Mistakes to Avoid ⚠️

Don't fall into these common traps when applying for funded accounts:

Overtrading: More trades don't equal more profits. Quality over quantity is key.

Ignoring Risk Management: This is the fastest way to lose a funded account.

Chasing Losses: Stick to your strategy, even after a losing streak.

Unrealistic Expectations: Funded trading is not a get-rich-quick scheme.

Neglecting Education: Continuous learning is crucial in the ever-changing markets.

Choosing the Right Prop Firm 🎯

Selecting the right prop firm is crucial for your success. Consider these factors:

Reputation and track record

Transparency of rules and processes

Quality of customer support

Educational resources and community

Scaling opportunities

Steps to Apply for a Funded Account 📋

Research: Thoroughly investigate different prop firms and their offerings.

Prepare: Refine your trading skills and develop a solid strategy.

Choose: Select a prop firm that aligns with your goals and trading style.

Apply: Complete the application process, which may include a background check.

Evaluation: Pass the trading challenge or evaluation phase.

Funding: Receive your funded account and start trading!

Ready to apply? Check out our top recommended prop firms.

Conclusion: Your Path to Funded Trading Success 🚀

Applying for a funded trading account is an exciting step in your trading career. By understanding the ins and outs of these programs, you can make an informed decision and set yourself up for success. Remember, the key to thriving with a funded account is a combination of skill, discipline, and choosing the right prop firm for your needs.

Are you ready to take the leap into funded trading? With the right preparation and mindset, you could be on your way to trading significant capital and potentially life-changing profits!

Ready to Start Your Funded Trading Journey? 🏁

We're here to help you navigate the world of funded trading accounts. Our expert recommendations are tailored to your trading style and goals, ensuring you find the perfect prop firm to kickstart your funded trading career.

Click here to get personalized prop firm recommendations.

💡 Pro Tip: Always read the terms and conditions carefully before applying for a funded account. Understanding the rules thoroughly can make the difference between success and failure in your funded trading journey.

What's your biggest question about applying for a funded trading account? Share your thoughts here! 💬